Xiaowei Hai , Tian Liao and Chanchan Zhao

Fresh Produce E-Commerce Supply Chain Coordination Considering Promotional and Freshness-Keeping Efforts

Abstract: Supply chain coordination plays a critical role in improving the enterprise performance and the competitive advantage of fresh e-commerce. This study explores the coordination problem of a two-echelon fresh produce e-commerce supply chain comprising a fresh e-commerce enterprise and a fresh supplier in a novel framework. In this framework, the fresh e-commerce sells fresh produce and provides promotion effort; meanwhile, the fresh supplier deliveries fresh produce and provides freshness-keeping effort. Specifically, the optimal decisions under centralized and decentralized decision-making are compared, and it is found that centralized decision-making is more profitable. Based on this work, we created a cost-sharing and revenue-sharing combination contract. This study demonstrates that this contract effectively coordinates the supply chain and makes both parties achieve Pareto optimization when the parameters meet certain conditions. Finally, the feasibility and validity of the contract are presented through a numerical example.

Keywords: Freshness-Keeping Effort , Fresh Produce E-commerce , Promotional Effort , Supply Chain Coordination

1. Introduction

With the prosperity of the e-commerce industry, fresh produce e-commerce has been developing rapidly, transforming many traditional fresh produce enterprises into this field. Fresh e-commerce platforms are attracting an increasing number of consumers to buy fresh produce online due to their advantages, such as low price, high freshness, and fast delivery. However, since 2019, with the increasingly fierce competition, many fresh e-commerce enterprises have carried out low price promotions, engaged in fresh festivals, and continued to fight price wars to occupy the market, resulting in long-term losses and operation crisis for some enterprises [1]. In early 2020, COVID-19 broke out suddenly, causing people to isolate at home. It greatly increased the demand for fresh delivery to the home. Moreover, many potential consumers gradually developed the habit of online ordering, thus rekindling fresh produce e-commerce. The data suggest that the annual transaction volume of e-commerce for fresh produce in 2020 was approximately 364.13 billion Yuan, a year-on-year increase of 42.54% [2]. Meanwhile, owing to the surge in demand and the perishable nature of fresh produce, maintaining supply chain balance has become a practical problem when facing the fresh produce e-commerce develop rapidly. This requires upstream and downstream enterprises to work closely by coordinating the relationship between promotion, freshness, and price in the supply chain. This method ultimately improves product freshness and provides consumers with high-quality and low-cost produce. Therefore, exploring how to coordinate the fresh produce e-commerce supply chain and make the two sides jointly improve the level of effort through design coordination contracts is both meaningful and critical.

Promotional effort is a critical way to increase the total profitability of the fresh produce e-commerce supply chain in the e-commerce environment. Howard Finch et al. [3] highlighted that the price is a strategic marketing variable that influences a consumer’s purchasing decisions and helps companies increase the sales revenue. Grewal et al. [4] noted that promotions include coupons, discounts, samples, and gifts. The promotions aim to increase the sales and market share. Lan and Yu [5] verified that a market leader must step up its promotional efforts. This is essential to stimulating product sales and supply chain profits. Heydari and Asl‐Najafi [6] demonstrated the importance of a retailer’s sales efforts in affecting demand. Promoting, offering appealing shelf space, and directing customer purchases with sales professionals are ways through which retailers may impact demand. Krishnan et al. [7] further researched the effect of retailer promotions on consumer demand and considered developing channel cooperation through promotions. Edelman et al. [8] explored the impact of online promotions on company profitability, concluding that online promotions may increase company profits, especially for relatively unknown firms and firms with lower marginal costs. Furthermore, Huo and Wang [9] examined the coordination of the agricultural product supply chain in which promotional efforts and sales prices jointly affect market demand; to organize the supply chain, a combination contract comprising “revenue + cost sharing + wholesale price discounts” was developed. By analyzing the literature, we found that fresh produce e-commerce should focus more on investments in promotions to increase product exposure, to allow customers to gain a better understanding of the product, and to increase customer pleasure and purchase intention, thereby expanding market demand and ultimately achieving the goal of increasing corporate profits.

Because fresh produce is perishable, investment in preservation must be considered in coordinating the fresh produce e-commerce supply chain. Dye and Yang [10] highlighted that product freshness is an important indicator of whether consumers will buy the product. For example, meat, fruits, live plants, and vegetables have a high failure rate and risk of damage; therefore, they must be stored and transported in special equipment. McLaughlin [11] elucidated that shorter supply chains can reduce costs by increasing inventory turnover, reducing the amount of storage in supply chain operations, and preventing the deterioration of perishable commodities. In addition, Cai et al. [12] demonstrated that the market demand for produce depends on the degree of freshness of the produce by examining a fresh produce supply chain comprising producers, third-party logistics (TPL), and customers. Similarly, Piao and Hu [13] considered the green preferences and freshness sensitivity of consumers. It was discovered that products with a higher level of greenness and freshness were more popular. Zheng et al. [14] explored the coordination problems of the fresh produce supply chain considering multiple factors, such as the transportation loss rate, freshness, and price. The sensitivity of consumers toward freshness was found to be positively associated with the profitability of the fresh produce supply chain. Cao et al. [15] showed that the advancement of the freshness degree is critical for reducing waste and improving total supply chain profitability and that increasing the elasticity coefficient of freshness enables consumers to accept a higher retail price, thereby enabling companies to generate higher profits. Similarly, using model design and a solution, some research has determined the ideal pricing, order amount, and freshness effort level in the supply chain. They concluded that e-retailers’ profits increased after they invested in freshness-keeping efforts. Thus, e-retailers are motivated to invest in freshness-keeping efforts [16,17]. Yang et al. [18] investigated the problem of agricultural supply chain coordination with asymmetric freshness information and designed appropriate repurchase contracts to ensure information sharing and supply chain coordination. Zheng et al. [19] believed that freshness information asymmetry would influence a supply chain’s total profits and determined that improved income-sharing contracts may effectively improve the degree of information sharing and increase overall profit.

In summary, numerous academics have undertaken research and practical explorations on issues concerning the coordination of fresh produce supply chain. These studies have rich theoretical guidance and practical significance. However, studies on the coordination of the fresh produce e-commerce supply chain are currently rare, and most relevant studies have only considered the impact of a single level of effort. However, in terms of the consumption-driven fresh e-commerce supply chain, the promotion and preservation level efforts will affect consumers’ purchase demand simultaneously. Moreover, compared with traditional offline stores, on e-commerce platforms, information acquisition is more convenient and transparent due to the transmission of online comment information. Moreover, consumers have a higher understanding of the level of promotion and preservation efforts of produce before purchasing it. Therefore, this study comprehensively considers the promotion effort invested by fresh e-commerce and the freshness-keeping effort provided by fresh produce supplier. It also explores the two-echelon supply chain coordination and optimization of fresh produce e-commerce.

The remainder of this paper is organized as follows. Section 2 presents a preliminary analysis of the work done before modeling, followed by a description of the basic decision-making models in Section 3. Section 4 discusses the coordination model. Section 5 provides a numerical example, and Section 6 concludes with a summary and recommendations for future research.

2. Problem Analysis

This section will describe the problem discussed in this study, including a detailed description of the operational mode of the fresh produce e-commerce supply chain, and it will propose several basic assumptions of the model construction that will lay the foundation for constructing the models in the following sections.

2.1 Problem Description

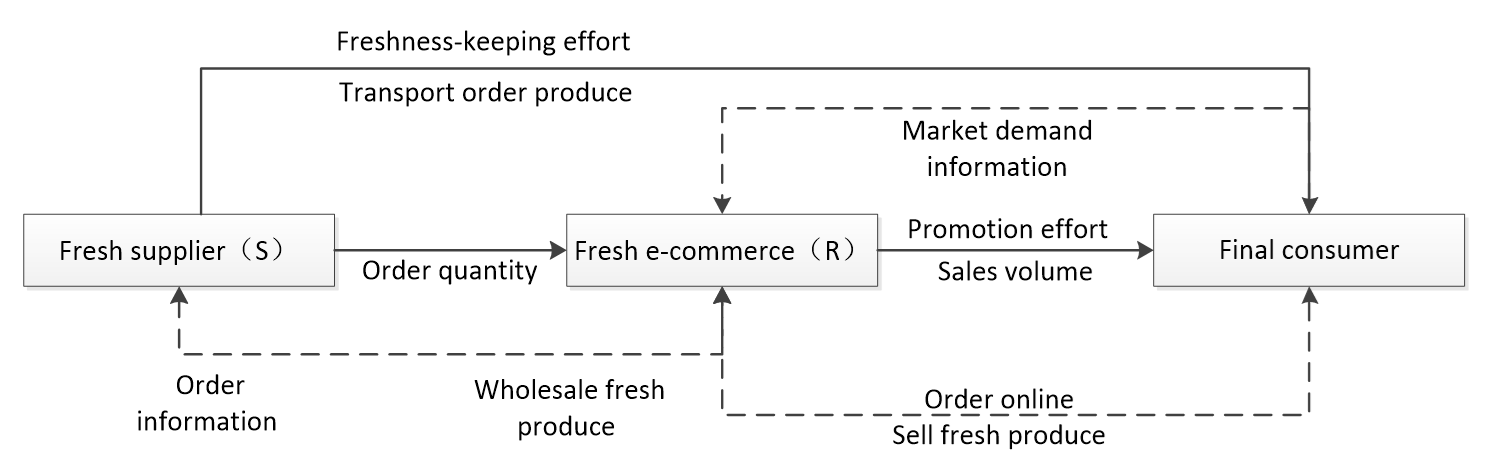

The e-commerce platform helps promote supply chain coordination and construction in the e commerce environment. We described a two-echelon fresh produce e-commerce supply chain formed by a fresh produce supplier (S) and a fresh produce e-commerce platform (R). Unlike the traditional supply chain, the fresh produce e commerce platform has a wealth of informational resources upon which the communi¬cation between members relies. E-commerce provides consumers with relevant commodity information, and targeted promotional services induce consumers to buy. Purchased produce is delivered to consumers by the fresh produce supplier that makes a freshness-keeping effort to ensure the freshness of the produce. Fig. 1 shows the operation of the fresh produce e-commerce supply chain.

2.2 Basic Assumptions

The following assumptions are made in this study:

(1) Each participant in the supply chain is fully rational and risk-averse, pursuing their own profit maximization principles and fully sharing information with members.

Let c be the fresh produce supplier’s unit manufacturing cost, w be the wholesale price, p be the retail price, [TeX:] $$e_1\left(e_1\gt 0\right)$$ be the freshness-keeping effort level, and [TeX:] $$e_2\left(e_2\gt 0\right)$$ be the promotional effort level. The demand for fresh produce is affected by p, [TeX:] $$e_1 \text{ and } e_2$$.

(3) Referring to the assumption proposed by Huang et al. [20], the market demand function for fresh produce is [TeX:] $$Q=a-b p+\alpha \theta_0 e_1+\beta e_2(a, b, \alpha, \beta\gt 0),$$ where a, b, , and denote the potential demand for produce, the elasticity coefficients of the price, the freshness-keeping effort level, and the promotional effort level, respectively.

(4) Following Cai et al. [21], [TeX:] $$\theta=\theta_0 e_1$$ characterizes produce freshness when the consumer receives it, and [TeX:] $$\theta_0$$ represents the initial freshness. Similar to the assumptions proposed by Ha et al. [22], the freshness-keeping and promotional cost functions can be expressed as [TeX:] $$C\left(e_1\right)=\frac{1}{2} k_1 e_1^2$$ and [TeX:] $$C\left(e_2\right)=\frac{1}{2} k_2 e_2^2,$$ respectively, where [TeX:] $$k_1 \text{ and } k_2$$ represent the freshness-keeping and promotional cost coefficients, respectively.

(5) To ensure that members at all levels are profitable, they must meet the condition [TeX:] $$p\gt w+c$$

3. Basic Decision Models

First, we build a centralized decision-making model for the fresh produce e-commerce supply chain as a benchmark. Subsequently, a decentralized decision-making model is constructed. Finally, by compa¬ring the optimal decision-making results of the two modes, we analyze the reasons underlying a lack of supply chain coordination under the decentralized decision-making model, providing a basis for constructing a supply chain coordination model in the next section.

3.1 Centralized Decision-Making Model

The fresh produce supplier and e-commerce company are considered collectively in this centralized decision-making model. They each make the best selections to maximize their total earnings. The supply chain’s overall profit function is as follows:

(1)

[TeX:] $$\pi=(p-c)\left(a-b p+\alpha \theta_0 e_1+\beta e_2\right)-\frac{1}{2} k_1 e_1^2-\frac{1}{2} k_2 e_2^2 .$$We take the first and second derivatives of Eq. (1) with regard to p, [TeX:] $$e_1 \text{ and } e_2$$. The Hessian matrix of is as follows:

(2)

[TeX:] $$H_1=\left[\begin{array}{ccc} -2 b & \alpha \theta_0 & \beta \\ \alpha \theta_0 & -k_2 & 0 \\ \beta & 0 & -k_1 \end{array}\right]=-2 b k_1 k_2+\beta^2 k_1+\alpha^2 \theta_0^2 k_2.$$This indicates that is a concave function of p, [TeX:] $$e_1 \text{ and } e_2$$ and that if [TeX:] $$-2 b k_1 k_2+\beta^2 k_1+\alpha^2 \theta_0^2 k_2 \lt 0$$, an optimal solution exists.

Let the first derivative of Eq. (1) with respect to p, [TeX:] $$e_1 \text{ and } e_2$$ equal 0. The optimal solutions for the centralized model’s decision-making variables are as follows:

(4)

[TeX:] $$e_1=\frac{\alpha k_2 \theta_0(a-b c)}{2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2},$$

(7)

[TeX:] $$\pi=\frac{(a-b c)^2 k_1 k_2}{2\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}.$$3.2 Decentralized Decision-Making Model

The fresh produce supplier and e-commerce only pursue their own interests in decentralized decision-making. The communication of various processes is transmitted through the fresh e-commerce because of its huge information resources. Thus, the fresh e-commerce platform is in the lead. The following is the game sequence: first, the fresh supplier predicts the order quantity of fresh e-commerce and gives the wholesale price and freshness-keeping effort level according to the product cost and profit. Then, to optimize its profit, the e-commerce platform reacts by determining the selling price and promotional effort level. The expected profit functions of the fresh e-commerce platform, the fresh supplier, and the supply chain are as follows:

We then take the first and second derivatives of Eq. (9) with regard to p and [TeX:] $$e_2$$, proving that [TeX:] $$\pi_s$$ is a concave function of p and [TeX:] $$e_2$$. The resulting optimal solution is as follows:

Substituting Eq. (11) and Eq. (12) into Eq. (8) to find the second derivative of [TeX:] $$e_1$$ by verifying that [TeX:] $$\pi_s$$ is a concave function of [TeX:] $$e_1$$, we obtain the following expression:

We may yield the following equations by solving Eq. (11), Eq. (12), and Eq. (13).

(14)

[TeX:] $$p^*=\frac{2 k_1 k_2\left(a-b w-w \beta^2\right)+(w-c) \alpha^2 k_2 \theta_0^2}{2 k_1\left(2 b k_2-\beta^2\right)},$$

(16)

[TeX:] $$e_2^*=\frac{2 \beta k_1(a-b w)+(w-c) \beta \alpha^2 \theta_0^2}{2 k_1\left(2 b k_2-\beta^2\right)} .$$Currently, demand, the e-commerce profit of fresh produce, the fresh produce supplier’s profit, and the supply chain’s total profit under decentralized decision-making conditions are as follows:

(17)

[TeX:] $$Q^*=\frac{2 b k_1 k_2(a-b w)+b k_2 \alpha^2 \theta^2(w-c)}{2 k_1\left(2 b k_2-\beta^2\right)},$$

(18)

[TeX:] $$\pi_r=\frac{k_2\left[2 k_1(a-b w)+(w-c) \alpha^2 \theta_0^2\right]^2}{8 k_1^2\left(2 b k_2-\beta^2\right)},$$

(19)

[TeX:] $$\pi_s=\frac{(w-c)(a-b w) 8 b k_1 k_2+(w-c)^2\left(\beta^2+2 b k_2\right) \alpha^2 \theta_0^2}{8 k_1^2\left(2 b k_2-\beta^2\right)},$$

(20)

[TeX:] $$\pi *=\frac{k_2\left[2 k_1(a-b w)+(w-c) \alpha^2 \theta_0^2\right]^2+(w-c)(a-b w) 8 b k_1 k_2+(w-c)^2\left(\beta^2+2 b k_2\right) \alpha^2 \theta_0^2}{8 k_1^2\left(2 b k_2-\beta^2\right)} .$$3.3 Comparison of Centralized and Decentralized Decision-Making Models

Proposition 1. 1) [TeX:] $$e_1^*\lt e_1, e_2^*\lt e_2 \text {; 2) } Q^*\lt Q, \pi^*\lt \pi \text {. }$$

Proof.

1) From Eq. (4), Eq. (15), Eq. (5), Eq. (16), we can obtain:

(21)

[TeX:] $$e_1-e_1^*=\frac{\alpha k_1 \theta_0 \beta^2(w-c)+2 \alpha k_1 k_2 \theta_0(a-b w)+\alpha^3 k_2 \theta_0^3(w-c)}{2 k_1\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}\gt 0,$$

(22)

[TeX:] $$e_2-e_2^*=\frac{2 b \beta k_1^2(w-c)\left(2 b k_2-\beta^2\right)+\alpha^2 \theta_0^2 \beta^2 k_1(w-c)+\alpha^2 \theta_0^2 k_1 k_2(a+b c-b w)+\alpha^4 k_2 \theta_0^4(w-c)}{2 k_1\left(2 b k_2-\beta^2\right)\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}\gt 0 .$$Therefore, [TeX:] $$e_1^*\lt e_1 ; e_2^*\lt e_2$$

2) Similarly, from Eq. (6), Eq. (17), Eq. (7), Eq. (20), we can obtain:

(23)

[TeX:] $$Q-Q^*=\frac{2 b^2 k_1^2 k_2(w-c)\left(2 b k_2-\beta^2\right)+\alpha^2 b k_1 k_2 \theta_0^2\left[(w-c) \beta^2+(a+b c-2 b w) k_2\right]+\alpha^4 b k_2^2 \theta_0^4(w-c)}{2 k_1\left(2 b k_2-\beta^2\right)\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}\gt 0,$$

(24)

[TeX:] $$\pi-\pi *=\frac{(a-b c)^2 k_1 k_2}{2\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}-\frac{k_2\left(2 k_1(a-b w)+(w-c) \alpha^2 \theta_0^2\right)^2+(w-c)(a-b w) 8 b k_1 k_2+(w-c)^2\left(\beta^2+2 b k_2\right) \alpha^2 \theta_0^2}{8 k_1^2\left(2 b k_2-\beta^2\right)}\gt 0.$$Therefore, [TeX:] $$Q^*\lt Q ; \pi^*\lt \pi .$$

Proposition 1 indicates that the optimal decision in a decentralized decision-making model is less than an ideal decision in the centralized decision-making model because in the decentralized decision-making model, both parties evaluate only their own profits, resulting in double marginal benefits. However, in real life, both members make decisions independently, and both parties hope that the other party will invest more effort and obtain greater profit independently. Fresh produce e-commerce increases retail prices and reduces promotional efforts to maximize its own profits; the fresh produce supplier will achieve its own interests by increasing wholesale prices and reducing investment in fresh produce preservation. Therefore, an incentive contract must be designed to coordinate the supply chain. Hence, in the next section, we propose a contract coordination model with cost-sharing and revenue-sharing to improve the inconsistency in the decentralized decision-making model; thus, both parties in the supply chain can maximize profits while enabling consumers to obtain quality produce at low prices.

4. Coordination Model

In the fresh produce e-commerce supply chain, when the fresh produce supplier invests in preservation efforts, it provides quality assurance for the produce sold by the fresh produce e-commerce platform and reduces the loss of customers. Moreover, during sales, fresh produce e-commerce will provide price and service promotions to attract additional consumers. Therefore, achieving the optimal promotional and freshness-keeping efforts will inevitably increase market demand as well as the costs of both parties. Therefore, we create a cost-sharing contract to address these issues. To increase the enthusiasm of both parties to perform the contract, we also consider a revenue-sharing contract. For the coordination model, most scholars use a Stackelberg or Nash equilibrium game. The Stackelberg game is more practical for analyzing fresh produce e-commerce. Wang et al. [23] established a Stackelberg and Nash equilibrium models to explore the fresh supply chain coordination and found that the cost-sharing Stackelberg model performed better than the Nash equilibrium model with cost-sharing attributes. Other scholars have conducted similar studies [13,17]. Therefore, we will establish a cost-sharing and revenue-sharing Stackelberg contract coordination model.

On the one hand, the fresh produce e-commerce platform shares [TeX:] $$\lambda_1\left(0\lt \lambda_1\lt 1\right)$$ percentage of the freshness-keeping cost of the fresh produce supplier; on the other hand, the fresh supplier shares [TeX:] $$\lambda_2\left(0\lt \lambda_2\lt 1\right)$$ percentage of the promotion cost of the fresh produce e-commerce platform. Additionally, before the produce is sold, the fresh e-commerce requests ask a lower wholesale price from the fresh produce supplier and shares [TeX:] $$\phi(0\lt \phi\lt 1)$$ percentage of the sales with supplier.

According to the aforementioned information, the profit function of the fresh produce e-commerce and supplier is as follows:

(25)

[TeX:] $$\pi_r^T=[(1-\phi) p-w]\left(a-b p+\alpha \theta_0 e_1+\beta e_2\right)-\frac{\lambda_1}{2} k_1 e_1^2-\frac{\left(1-\lambda_2\right)}{2} k_2 e_2^2,$$

(26)

[TeX:] $$\pi_s^T=(w-c+\phi p)\left(a-b p+\alpha \theta_0 e_1+\beta e_2\right)-\frac{\left(1-\lambda_1\right)}{2} k_1 e_1^2-\frac{\lambda_2}{2} k_2 e_2^2.$$Currently, we acquire the optimal solution as follows:

(27)

[TeX:] $$p^T=\frac{\alpha^2 \theta^2 k_2\left(1-\lambda_2\right)(c-c \phi+2 \phi w-w)+2 k_1\left(1-\lambda_1\right)\left[w \beta^2(1-\phi)-k_2\left(1-\lambda_2\right)(a+b w-a \phi)\right]}{2(1-\phi)\left[\beta^2 k_1(1-\phi)\left(1-\lambda_1\right)+\alpha^2 \theta^2 k_2 \phi\left(1-\lambda_2\right)-2 b k_1 k_2\left(1-\lambda_1\right)\left(1-\lambda_2\right)\right]},$$

(28)

[TeX:] $$e_1^T=\frac{\alpha \theta_0^2 \beta^2(w-c-c \phi)-2 \alpha b k_2 \theta_0^2\left(1-\lambda_2\right)(w-c+a \phi)}{2\left[\beta^2 k_1(1-\phi)\left(1-\lambda_1\right)+\alpha^2 \theta_0^2 k_2 \phi\left(1-\lambda_2\right)-2 b k_1 k_2\left(1-\lambda_1\right)\left(1-\lambda_2\right)\right]},$$

(29)

[TeX:] $$e_2^T=\frac{\alpha^2 \theta_0^2 \beta(w+c-c \phi)+2 b w \beta k_1\left(1-\lambda_1\right)-2 a \beta k_1(1-\phi)\left(1-\lambda_1\right)}{2\left[\beta^2 k_1(1-\phi)\left(1-\lambda_1\right)+\alpha^2 \theta_0^2 k_2 \phi\left(1-\lambda_2\right)-2 b k_1 k_2\left(1-\lambda_1\right)\left(1-\lambda_2\right)\right]}.$$Proposition 2. 1) When the cost-sharing and revenue-sharing contract [TeX:] $$(\lambda_1, \lambda_2, \varphi, w)$$ is satisfied by the condition [TeX:] $$w=c(1-\phi), \lambda_1=1-\phi, \lambda_2=\phi,$$ the supply chain can be coordinated; 2) [TeX:] $$(\varphi_1, \varphi_2)$$ exists; when [TeX:] $$\varphi$$ is within this range, both supply chain members can realize Pareto improvement. Pareto improvement, in the supply chain, implies that when the supply chain’s total profit remains unchanged, the income of one or more supply chain members increases without reducing the income of the other supply chain members.

Proof.

1) Based on the optimal solutions to the centralized decision-making model, the necessary condition for supply chain coordination under a coordination contract is [TeX:] $$p=p^T, e_1=e_1^T, e_2=e_2^T,$$ and using simultaneous equations, we can obtain [TeX:] $$w=c(1-\phi), \lambda_1=1-\phi, \lambda_2=\phi.$$

Substituting [TeX:] $$w=c(1-\phi), \lambda_1=1-\phi, \lambda_2=\phi$$ into Eq. (25) and Eq. (26), the optimal profit of the fresh produce e-commerce and supplier is calculated as follows:

(30)

[TeX:] $$\pi_r^T=\frac{(1-\phi)(a-b c)^2 k_1 k_2}{2\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}=(1-\phi) \pi,$$

(31)

[TeX:] $$\pi_s^T=\frac{\phi(a-b c)^2 k_1 k_2}{2\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}=\phi \pi .$$2) Let [TeX:] $$\Delta \pi_r=\pi_r^T-\pi_r^*,$$ and [TeX:] $$\Delta \pi_s=\pi_s^T-\pi_s^*.$$ When [TeX:] $$\pi_r^T \geq \pi_r^*, \pi_s^T \geq \pi_s^*$$ is satisfied, the supply chain can achieve Pareto improvement.

Because [TeX:] $$\frac{\partial \Delta \pi_s}{\partial \varphi}=\frac{(a-b c)^2 k_1 k_2}{2\left(2 b k_1 k_2-\beta^2 k_1-\alpha^2 k_2 \theta_0^2\right)}\gt 0,$$ then [TeX:] $$\Delta \pi_r$$ is a monotonically increasing function with respect to [TeX:] $$\varphi$$ and is continuously differentiable in [TeX:] $$\varphi \in [0,1].$$ Moreover, [TeX:] $$(\varphi_1 ,1]$$ exists, when [TeX:] $$\varphi \in (\varphi_1,1]$$ thus, the fresh produce supplier’s profit after coordination is better than before. Similarly, [TeX:] $$[0, \varphi_2)$$ exists, when [TeX:] $$\varphi \in [0, \varphi_2)$$; the profit from fresh produce e-commerce after coordination is greater than before. This calculation yields [TeX:] $$\varphi_2-\varphi_1\gt 0 \text {, then } \varphi_2\gt \varphi$$. Therefore, when [TeX:] $$\varphi \in\left(\varphi_1, \varphi_2\right), \pi_r^T \geq \pi_r^*, \pi_s^T \geq \pi_s^*.$$

Proposition 2 demonstrates that when certain conditions are satisfied, the price, total profit, freshness-keeping efforts, and promotional efforts ([TeX:] $$\lambda_1, \lambda_2, \varphi, w$$) are the same as in the centralized decision-making model. This suggests that the double marginal effect can also be eliminated under a decentralized decision-making model. Therefore, the coordination contract proposed in this study may effectively realize supply chain coordination and optimization.

5. Numerical Example

To further validate the effectiveness of the contract coordination, we verified an example in this section. According to the constructed model’s conditions, the parameters are assigned as follows: [TeX:] $$a=200, b=10, k_1=10, k_2=8, \alpha=3, \beta=4, c=5, w=8, \theta_0=1.$$ Table 1 and Figs. 2–6 show the corresponding results.

Table 1 shows that in a decentralized decision-making model, barring the price, the freshness-keeping and promotional effort levels, demand, and total profit are less than those in a centralized decision-making model, thereby verifying Proposition 1. Moreover, after adopting a combined contract, the level of promotion, preservation efforts, and profit increase. This demonstrates that a contract may improve supply chain coordination while maximizing the individual interests of the supply chain members.

Table 1.

| Variable | p | [TeX:] $$e_1$$ | [TeX:] $$e_2$$ | Q | [TeX:] $$\pi_r$$ | [TeX:] $$\pi_s$$ | [TeX:] $$\pi$$ |

|---|---|---|---|---|---|---|---|

| Centralized decision-making model | 13.77 | 2.64 | 4.38 | 87.71 | - | - | 657.89 |

| Decentralized decision-making model | 14.74 | - | - | - | N/A | 201.23 | 610.28 |

| Coordination contract | 13.77 | 2.64 | 4.38 | 87.71 | - | - | 657.89 |

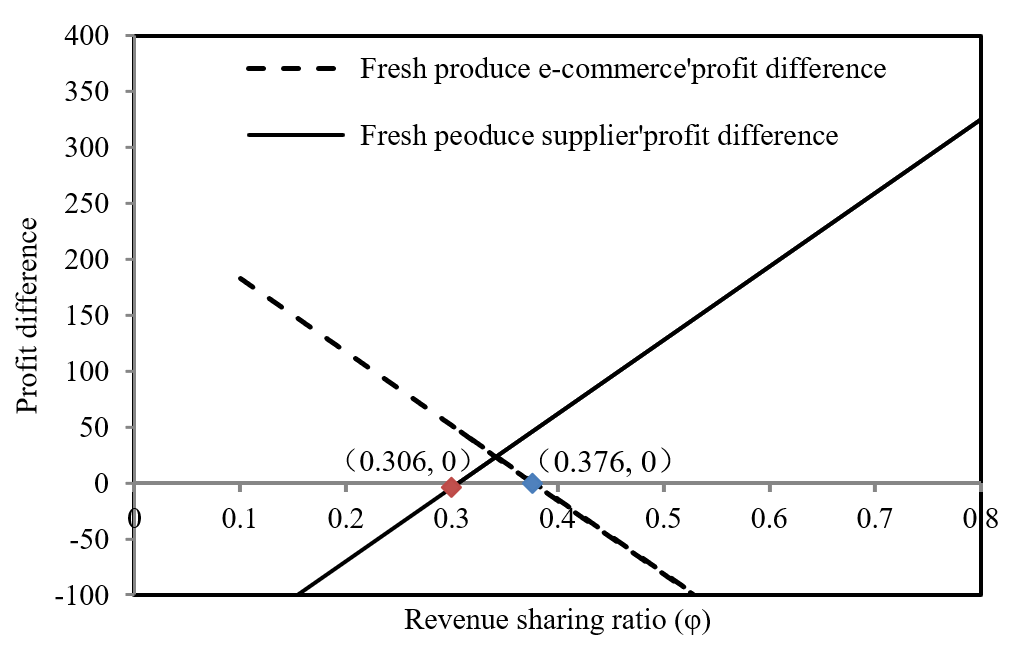

Fig. 2 illustrates that after implementing the coordination contract model, with an increase in [TeX:] $$\varphi$$, the profit of the fresh produce supplier keeps increasing, whereas the profit of the fresh produce e-commerce company decreases. When [TeX:] $$\varphi \in\left(\varphi_1, \varphi_2\right),$$ in this example [TeX:] $$\varphi_1=0.306, \varphi_2=0.376 \text {, }$$ the revenue of both partners in the supply chain will be greater after coordination than before. At this moment, the coordination of the fresh produce e-commerce supply chain and Pareto improvement of both sides of the supply chain can be achieved.

5.1 Effect of Effort Level Elasticity Coefficient on Effort Levels of Both Parties

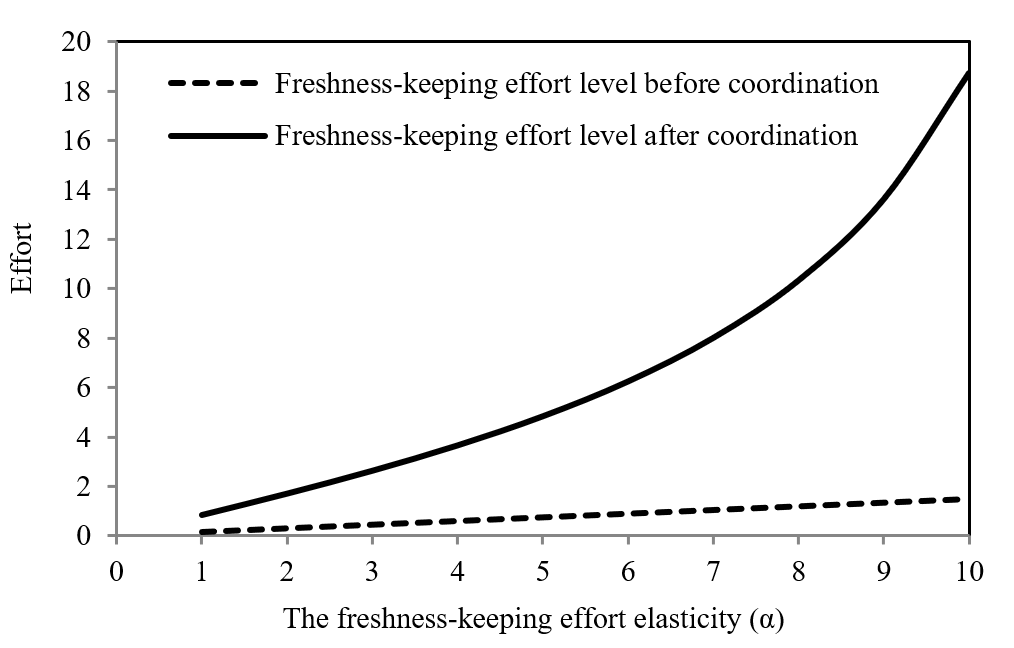

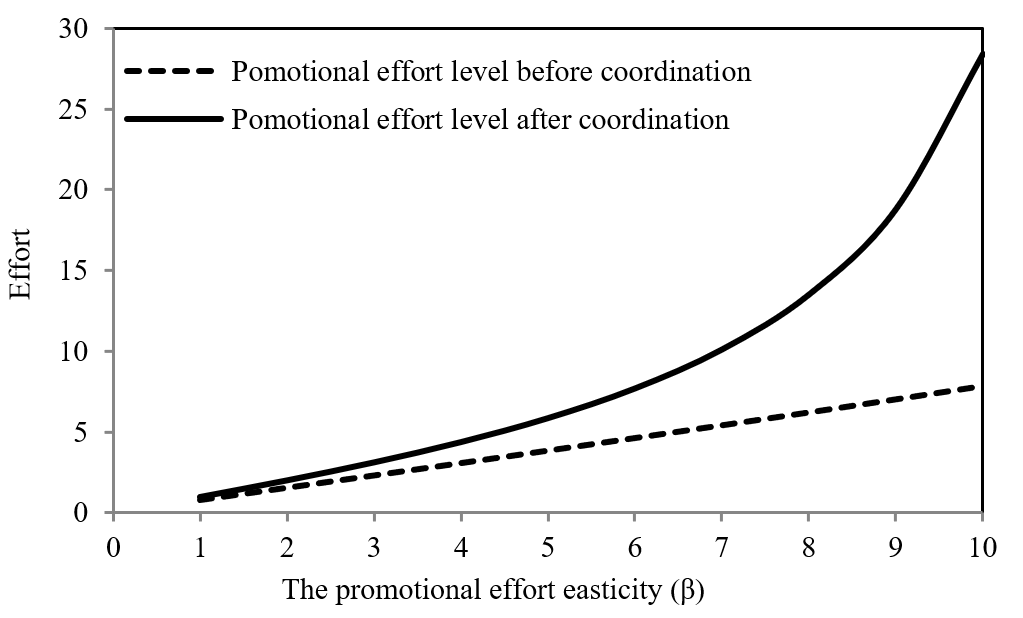

Figs. 3 and 4 illustrate that as the freshness-keeping effort elasticity coefficient and the promotional effort elasticity coefficient improve, the levels of promotional and freshness-keeping effort improve as well. The elasticity coefficient positively affects their respective effort levels. Moreover, an increase in and yields a more significant gap between the effort levels before and after coordination, and the coordination effect will become more apparent. This shows that the more sensitive consumers are to the promotion and freshness level of the produce, the more motivated all parties are to improve their promotion and freshness efforts continuously. Additionally, when and are fixed, the promotional and freshness-keeping effort after coordination are higher, indicating the potential of coordinate contract to effectively improve the effort of all parties.

5.2 Effect of Effort Level Elasticity on the Profits of Both Parties

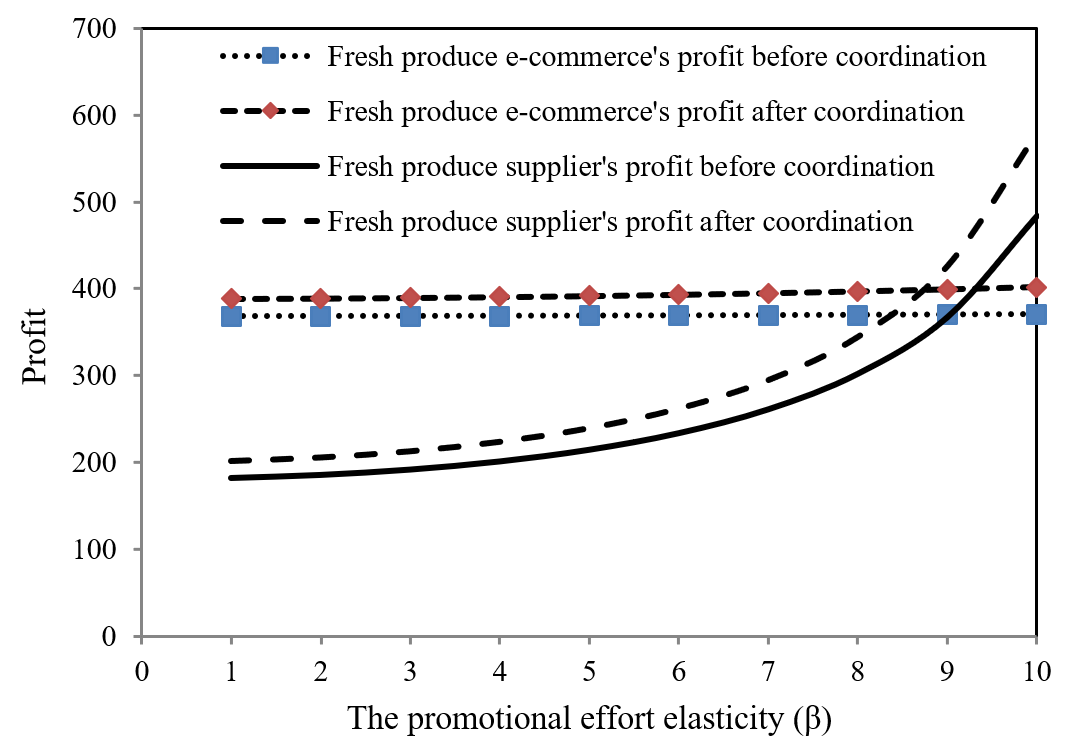

According to the aforementioned parameters, we set [TeX:] $$\varphi=\frac{\varphi_1+\varphi_2}{2}=0.34$$. The effects of the elasticity coefficient of the effort level on profits are discussed.

Figs. 5 and 6 reveal that the profits of the two parties increase as the freshness of the produce improves. This indicates that produce with a higher level of freshness is more popular, may promote consumer purchases, and may generate more benefits for the supply chain. When the elasticity coefficient of the promotional effort is greater, consumers are more sensitive to the promotional effort level. Investing in more promotional efforts will therefore increase consumer demand. Furthermore, the profits of both members after coordination are better than before, indicating that cost-sharing and revenue-sharing contracts can help reduce the double marginal effect in the supply chain and increase both parties’ profitability. Therefore, fresh produce suppliers and e-commerce platforms should work collaboratively to improve the effort level. On the one hand, fresh produce suppliers use advanced transportation equipment and preservation technology to increase the freshness of their produce; on the other hand, fresh produce e-commerce platforms can use its own data resources to promote more effective and targeted promotions of fresh produce. Ultimately, this will enable the achievement of win–win cooperation between both parties in the supply chain.

6. Conclusion

Supply chain coordination plays a critical role in improving the enterprise performance and the competitive advantage of fresh e-commerce. This study explored the decision and coordination of the two-echelon fresh produce e-commerce supply chain in a novel framework. This study’s primary contributions are as follows:

(1) By comparing and analyzing the centralized and decentralized decision-making under the non-contract model. We discovered that the centralized model had higher levels of preservation and promotional effort, consumer demand, and overall supply chain profit than the decentralized approach.

(2) By constructing a contract of cost-sharing and revenue-sharing, we realized the coordination of the fresh e-commerce supply chain. When each parameter in the contract meets certain conditions, the Pareto improvement of the supply chain can be achieved.

(3) After the introduction of the contract, the levels of product preservation and promotion effort are greater. Therefore, the fresh supplier and the fresh produce e-commerce should collaborate to raise the level of promotion and freshness-keeping efforts and achieve a win–win situation to achieve a virtuous cycle of supply chain.

Although this study provides some thought-provoking insights and managerial ramifications, it still has some limitations. This study conducts some preliminary research on the coordination of fresh produce e-commerce supply chain, but it does not consider the relation between freshness and time and the relation between freshness and promotion. In addition, it is limited to the two-echelon supply chain situation with complete information symmetry and certain level of market demand. However, in real life, information cannot be fully symmetrical, and demand is random and uncertain in numerous cases. The next step will be to study the coordination mechanism of a three-level fresh produce e commerce supply chain under information asymmetry or random demand to obtain a more general application scenario.

Biography

Xiaowei Hai

https://orcid.org/0000-0003-3406-7150He received a Ph.D. from the School of Economics and Management at Beijing Jiaotong University in 2014. He is currently an associate professor at the School of Economics and Management, Inner Mongolia University of Technology in Hohhot, China. His research interests include logistics, supply chain management, and information management.

Biography

Tian Liao

https://orcid.org/0000-0003-3384-2047She received a B.S. from the School of Economics and Management at Beihua University in 2020. She is currently pursuing a master’s degree from the School of Economics and Management, Inner Mongolia University of Technology in Hohhot, China. Her research interests include logistics and supply chain management.

Biography

Chanchan Zhao

https://orcid.org/0000-0002-5441-4597She received a Ph.D. from the School of Computer and Information Technology at Beijing Jiaotong University in 2018. She is currently an associate professor in the College of Information Engineering, Inner Mongolia University of Technology in Hohhot, China. Her research interests include optimization theory and methodology and information management.

References

- 1 M. Y . Zan, G. Chen, and Z. B. Wang, "Development of e-commerce of fresh agricultural products in China: progress, difficulties and strategies," On Economic Problems, vol. 2020, no. 12, pp. 68-74, 2020.custom:[[[-]]]

- 2 A. Zhao, "Analysis of the development status, opportunities and trends of China's fresh food e-commerce industry in 2020," 2020 (Online). Available: https://www.iimedia.cn/c1020/70125.html.custom:[[[https://www.iimedia.cn/c1020/70125.html]]]

- 3 J. Howard Finch, R. C. Becherer, and R. Casavant, "An option‐based approach for pricing perishable services assets," Journal of Services Marketing, vol. 12, no. 6, pp. 473-483, 1998. https://doi.org/10.1108/08876049 810242759doi:[[[10.1108/08876049810242759]]]

- 4 D. Grewal, K. L. Ailawadi, D. Gauri, K. Hall, P . Kopalle, and J. R. Robertson, "Innovations in retail pricing and promotions," Journal of Retailing, vol. 87(Supplement 1), pp. S43-S52, 2011. https://doi.org/10.1016/ j.jretai.2011.04.008doi:[[[10.1016/j.jretai.2011.04.008]]]

- 5 C. Lan and X. Y u, "Revenue sharing-commission coordination contract for community group buying supply chain considering promotion effort," Alexandria Engineering Journal, vol. 61, no. 4, pp. 2739-2748, 2022. https://doi.org/10.1016/j.aej.2021.07.043doi:[[[10.1016/j.aej.2021.07.043]]]

- 6 J. Heydari and J. Asl‐Najafi, "A revised sales rebate contract with effort‐dependent demand: a channel coordination approach," International Transactions in Operational Research, vol. 28, no. 1, pp. 438-469, 2021. https://doi.org/10.1111/itor.12556doi:[[[10.1111/itor.12556]]]

- 7 H. Krishnan, R. Kapuscinski, and D. A. Butz, "Coordinating contracts for decentralized supply chains with retailer promotional effort," Management Science, vol. 50, no. 1, pp. 48-63, 2004. https://doi.org/10.1287/ mnsc.1030.0154doi:[[[10.1287/mnsc.1030.0154]]]

- 8 B. Edelman, S. Jaffe, and S. D. Kominers, "To groupon or not to groupon: the profitability of deep discounts," Marketing Letters, vol. 27, pp. 39-53, 2016. https://doi.org/10.1007/s11002-014-9289-ydoi:[[[10.1007/s11002-014-9289-y]]]

- 9 H. Huo and Z. T. Wang, "A study on coordination of agricultural products supply chain considering retailers' promotion efforts," Statistics & Decision, vol. 36, no. 11, pp. 184-188, 2020. https://doi.org/10.13546/j.cnki. tjyjc.2020.11.039doi:[[[10.13546/j.cnki.tjyjc.2020.11.039]]]

- 10 C. Y . Dye and C. T. Yang, "Optimal dynamic pricing and preservation technology investment for deteriorating products with reference price effects," Omega, vol. 62, pp. 52-67, 2016. https://doi.org/10.1016/j.omega. 2015.08.009doi:[[[10.1016/j.omega.2015.08.009]]]

- 11 K. McLaughlin, "Priceline’s ex-CEO puts eggs in basket of an online grocer," Wall Street Journal, 2005 (Online). Available: https://www.wsj.com/articles/SB111767354259948886.custom:[[[https://www.wsj.com/articles/SB111767354259948886]]]

- 12 X. Cai, J. Chen, Y . Xiao, X. Xu, and G. Y u, "Fresh-product supply chain management with logistics outsourcing," Omega, vol. 41, no. 4, pp. 752-765, 2013. https://doi.org/10.1016/j.omega.2012.09.004doi:[[[10.1016/j.omega.2012.09.004]]]

- 13 H. Piao and X. Hu, "The coordination of three-level fresh agricultural product supply chain oriented to green and fresh consumption," Industrial Engineering Journal, vol. 23, no. 4, pp. 1-10, 2020.custom:[[[-]]]

- 14 Q. Zheng, P. Ieromonachou, T. Fan, and L. Zhou, "Supply chain contracting coordination for fresh products with fresh-keeping effort," Industrial Management & Data Systems, vol. 117, no. 3, pp. 538-559, 2017. https://doi.org/10.1108/IMDS-04-2016-0139doi:[[[10.1108/IMDS-04-2016-0139]]]

- 15 Y . Cao, Y . M. Li, and G. Y . Wan, "Study on the fresh degree incentive mechanism of fresh agricultural product supply chain based on consumer utility," Chinese Journal of Management Science, vol. 26, no. 2, pp. 160174, 2018. https://doi.org/10.16381/j.cnki.issn1003-207x.2018.02.017doi:[[[10.16381/j.cnki.issn1003-207x.2018.02.017]]]

- 16 B. Gu, Y . Fu, and Y . Li, "Fresh-keeping effort and channel performance in a fresh product supply chain with loss-averse consumers’ returns," Mathematical Problems in Engineering, vol. 2018, article no. 4717094, 2018. https://doi.org/10.1155/2018/4717094doi:[[[10.1155/2018/4717094]]]

- 17 M. L. Liu, B. Dan, and S. X. Ma, "Optimal strategies and coordination of fresh e-commerce supply chain considering freshness-keeping effort and value-added service," Chinese Journal of Management Science, vol. 28, no. 8, pp. 76-88, 2020. https://doi.org/10.16381/j.cnki.issn1003-207x.2020.08.007doi:[[[10.16381/j.cnki.issn1003-207x.2020.08.007]]]

- 18 Y . Yang, T. J. Fan, and L. Zhang, "Coordination of fresh agricultural supply chain with asymmetric freshness information," Chinese Journal of Management Science, vol. 24, no. 9, pp. 147-155, 2016. https://doi.org/ 10.16381/j.cnki.issn1003-207x.2016.09.018doi:[[[10.16381/j.cnki.issn1003-207x.2016.09.018]]]

- 19 Q. Zheng, T. Fan, and L. Zhang, "The revenue sharing contract of fresh agricultural products under the mode of "agricultural supermarket docking"," Journal of Systems & Management, vol. 28, no. 4, pp. 742-751, 2019.custom:[[[-]]]

- 20 Y . Huang, L. Liu, and E. Qi, "The dynamic decision in risk-averse complementary product manufacturers with corporate social responsibility," Kybernetes, vol. 45, no. 2, pp. 244-265, 2016. https://doi.org/10.1108/K01-2015-0032doi:[[[10.1108/K01-2015-0032]]]

- 21 X. Cai, J. Chen, Y . Xiao, and X. Xu, "Optimization and coordination of fresh product supply chains with freshness‐keeping effort," Production and Operations Management, vol. 19, no. 3, pp. 261-278, 2010. https://doi.org/10.1111/j.1937-5956.2009.01096.xdoi:[[[10.1111/j.1937-5956.2009.01096.x]]]

- 22 A. Y . Ha, S. Tong, and H. Zhang, "Sharing demand information in competing supply chains with production diseconomies," Management Science, vol. 57, no. 3, pp. 566-581, 2011. https://doi.org/10.1287/mnsc.1100.1295doi:[[[10.1287/mnsc.1100.1295]]]

- 23 G. Wang, P . Ding, H. Chen, and J. Mu, "Green fresh product cost sharing contracts considering freshnesskeeping effort," Soft Computing, vol. 24, pp. 2671-2691, 2020. https://doi.org/10.1007/s00500-019-03828-4doi:[[[10.1007/s00500-019-03828-4]]]